How many people own bitcoin

Bitcoin has gained popularity as a digital currency that is decentralized and secure. One question that often arises is how many people actually hold bitcoin. In order to gain a better understanding of the number of bitcoin holders, it is important to explore a variety of sources and perspectives. The following list of articles offers different insights and data points that can help shed light on this topic.

Examining the Demographics of Bitcoin Holders

Bitcoin has taken the world by storm in recent years, with its value skyrocketing and attracting investors from all walks of life. But who exactly are these investors? A recent study delved into the demographics of Bitcoin holders to shed light on this growing trend.

The study revealed some interesting findings about the typical Bitcoin holder. One key demographic trend is that the majority of Bitcoin investors are male, with women making up only a small percentage of holders. This gender disparity is something that the cryptocurrency industry will need to address in order to attract a more diverse range of investors.

Another notable finding is that the majority of Bitcoin holders are relatively young, with the average age being in the 30s. This suggests that younger generations are more open to investing in cryptocurrencies compared to older generations.

Additionally, the study found that a significant portion of Bitcoin holders have a higher level of education, with many holding advanced degrees. This indicates that Bitcoin investment is not just a hobby for the tech-savvy, but rather a serious financial endeavor for many well-educated individuals.

Overall, the demographics of Bitcoin holders paint a picture of a young, male-dominated, and well-educated investor base. As Bitcoin continues to gain popularity and mainstream acceptance, it will be interesting to see how these demographics evolve in the future.

Analyzing the Growth of Bitcoin Wallets Worldwide

In recent years, the widespread adoption of cryptocurrencies like Bitcoin has led to a surge in the number of Bitcoin wallets worldwide. These digital wallets serve as a secure way for individuals to store, send, and receive their digital assets. The growth of Bitcoin wallets can be attributed to several factors, including the increasing acceptance of cryptocurrency as a legitimate form of payment, the rise of online shopping, and the growing interest in alternative investments.

One of the key drivers of the growth of Bitcoin wallets is the increasing number of merchants that accept Bitcoin as a form of payment. Companies like Microsoft, Overstock, and Expedia now allow customers to pay for goods and services using Bitcoin, making it easier for individuals to use their digital assets in everyday transactions. Additionally, the rise of online shopping has made it more convenient for people to buy and sell Bitcoin, leading to an increase in the number of wallets being created.

Famous figures like Elon Musk, Jack Dorsey, and Mark Cuban have also contributed to the popularity of Bitcoin, with many of them publicly endorsing the cryptocurrency. Their support has helped to legitimize Bitcoin in the eyes of the public and has encouraged more people to invest in digital assets.

Overall, the growth of Bitcoin wallets worldwide is a testament to the increasing mainstream acceptance of cryptocurrency. As more

Estimating the Number of Active Bitcoin Addresses

In the world of cryptocurrency, understanding the number of active Bitcoin addresses is crucial for various reasons. A recent study delved into this topic, providing valuable insights into the estimation process. The research utilizes a combination of methodologies to accurately gauge the number of active Bitcoin addresses, shedding light on the dynamics of the market.

The findings of the study reveal the significance of tracking active Bitcoin addresses for monitoring trends, analyzing user behavior, and predicting market movements. By employing statistical models and data analysis techniques, researchers were able to uncover patterns and correlations within the Bitcoin network. This information is instrumental for investors, analysts, and policymakers alike, offering a deeper understanding of the cryptocurrency landscape.

Moving forward, it is essential to consider certain factors when estimating the number of active Bitcoin addresses. Firstly, the study emphasizes the importance of data accuracy and reliability to ensure precise calculations. Additionally, exploring the impact of external factors such as regulatory changes and market sentiment can provide a more comprehensive picture of address activity. By taking these aspects into account, researchers can enhance the accuracy and relevance of their estimations, contributing to a better understanding of the Bitcoin ecosystem.

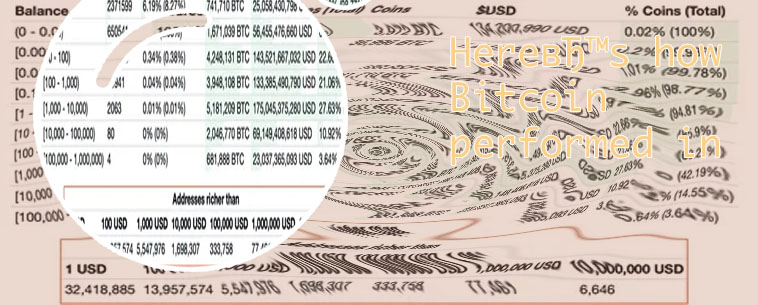

Tracking the Distribution of Bitcoin Ownership

Bitcoin, the world's first decentralized cryptocurrency, has gained significant popularity in recent years. As the value of Bitcoin continues to rise, there has been growing interest in understanding the distribution of Bitcoin ownership. Tracking the distribution of Bitcoin ownership is crucial for a variety of reasons, including understanding market dynamics, identifying potential risks, and ensuring the security and stability of the Bitcoin network.

One of the key methods used to track the distribution of Bitcoin ownership is through the analysis of Bitcoin addresses. By analyzing the distribution of Bitcoin across different addresses, researchers can gain valuable insights into the concentration of wealth within the Bitcoin network. This information can help to identify potential market manipulations, as well as provide a better understanding of the overall health of the Bitcoin ecosystem.

Furthermore, tracking the distribution of Bitcoin ownership can also help to identify potential security vulnerabilities within the network. By monitoring the ownership of large amounts of Bitcoin, researchers can be alerted to any potential threats to the network's security, allowing for more proactive measures to be taken to protect the integrity of the Bitcoin network.

Overall, tracking the distribution of Bitcoin ownership is essential for anyone involved in the cryptocurrency market, including investors, traders, and regulators. By understanding how Bitcoin ownership is distributed, stakeholders can make more informed decisions about their involvement in the market, ultimately leading

- Where to buy catgirl crypto

- Where can i buy safemoon crypto

- How does btc mining work

- Dogecoin to $1

- Shiba inu coin cryptocurrency

- Coinbase crypto list

- Bit coin price in us

- Crypto com nft

- Bit price

- Coinbase cryptocurrency prices

- Shop with crypto

- Cryptocurrency app

- 270 addresses are responsible all cryptocurrency

- New crypto coins

- Where to buy crypto

- Buy bitcoin online

- How to spend bitcoin

- How to buy on cryptocom

- 1 cent crypto

- Cryptocom cards

- How much is bitcoin

- Top cryptos today

- Cryptocurrency bitcoin price

- All crypto coins

- Price of bitcoins in usd

- Ethereum price coinbase

- How much is 1eth

- How does bit coin work

- Where to buy ethereum

- Buy bitcoin uk

- Dogecoin news

- Bitcoin strength indicator

- Crypto earn interest

- The crypto

- Crypto coin wallet

- Crypto wallet app

- Usd to eth

- Where to buy bitcoin

- Cryptocurrency software

- Best crypto to buy

- Binance dogecoin usd

- Today's bitcoin cash price

- Bitcoin gas fee

- Btc miner app

- Crypto and blockchain

- Cryptocom sell to fiat wallet

- Celo crypto price

- Buy eth with btc

- Bitcoin starting price

- Ave crypto

- Buy sand crypto

- Bitcoin futures

- Bitcoin crash prediction

- Btc live price

- Apps cryptocurrency

- How to withdraw money from cryptocom

- Top cryptos

- How much is dogecoin